Leasing and financing are two common options for acquiring a car, each with its advantages and considerations. Here's a comparison of leasing and financing a car:

Leasing:

1. Lower Monthly Payments: Lease payments are typically lower compared to loan payments for a similar vehicle since you are essentially paying for the depreciation of the car during the lease term.

2. Lower Upfront Costs: Lease agreements often require a lower down payment or, in some cases, no down payment at all. This can make it more accessible for individuals with limited upfront funds.

3. Warranty Coverage: Lease terms often coincide with the manufacturer's warranty period, meaning that maintenance and repair costs are generally covered under warranty during the lease term.

4. Regular Vehicle Updates: Leasing allows you to drive a new car every few years, providing access to the latest models and technologies.

5. Mileage Restrictions: Lease agreements typically have mileage limitations, and exceeding the specified mileage can result in additional fees. If you have a long commute or frequently take long trips, you may need to consider the mileage limitations carefully.

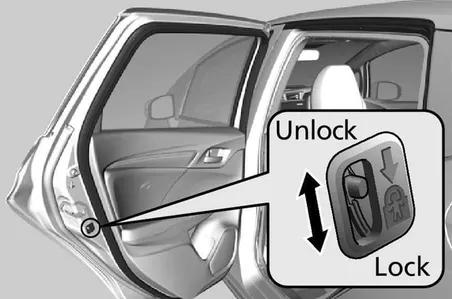

6. Limited Customization: Since you don't own the vehicle, lease agreements often come with restrictions on modifications or customizations.

Financing:

1. Ownership: Financing a car allows you to own the vehicle outright once you complete the loan payments. You can keep it for as long as you want and sell it or trade it in when you decide to upgrade.

2. Equity and Asset: As you make loan payments, you build equity in the vehicle, which can be beneficial when you want to sell or trade it in the future.

3. No Mileage Restrictions: Unlike leases, there are no mileage limitations when you own a car, giving you the freedom to drive as much as you want without incurring additional fees.

4. Flexibility: With ownership, you have the flexibility to customize the vehicle to your liking, making modifications or alterations as desired.

5. Higher Monthly Payments: Loan payments are typically higher compared to lease payments since you are paying for the entire cost of the vehicle, including depreciation and interest charges.

6. Responsibility for Maintenance and Repairs: As the owner, you are responsible for all maintenance and repair costs once the warranty expires.

When deciding between leasing and financing, consider your budget, driving habits, desired vehicle turnover, and personal preferences. Assess the financial implications, long-term goals, and potential costs associated with each option. It can be helpful to evaluate multiple financing offers, compare total costs over the desired ownership or lease term.

Lets explore which works best for you. Lets connect.

Robert Moy